Chartered Institute of Taxation of Nigeria(CITN) ,will on Wednesday and Thursday, January 25-26, hold South East zonal Tax conference in Enugu.

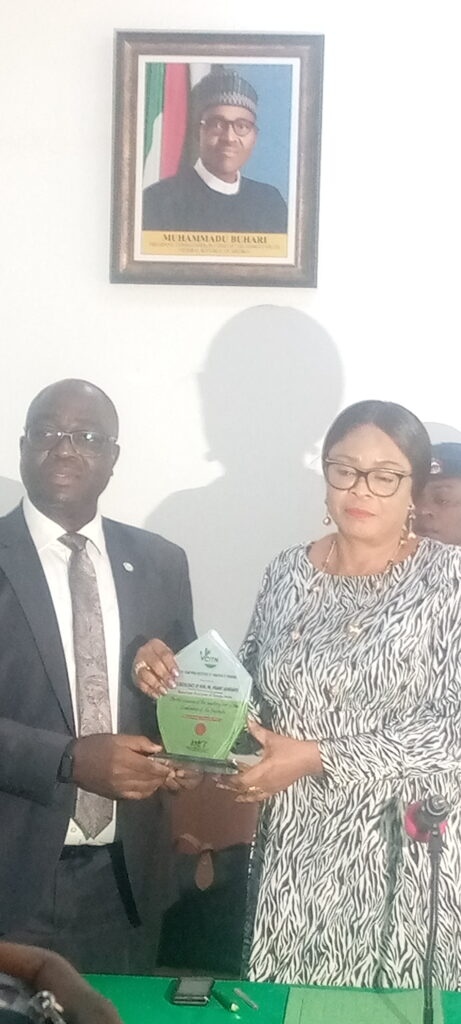

This was made known by the president of the Institute, Chief Adebayo Adesina, when he led a delegation of the leadership of the Institute on a courtesy visit to the Governor of Enugu state, Rt. Hon.(Dr)Ifeanyi Ugwuanyi at Government House, Enugu, on Tuesday.

Adesina ,who was represented by the Vice President of the Institute, Barrister Samuel Agbeluyi said that the Theme of the Conference is “Taxation and Sustainable Development in Nigeria -A Case of the South East Zone”. The conference which will be the first to be held in the south east zone,he said, will be intellectually stimulating .

He said that members of the public would be sensitized on the need for them to always pay their taxes, noting that the benefits gotten when citizens paid their taxes were enormous.

Taxation, according to him , is an off-shoot of the law . He said that CITN was doing a lot to get Nigeria out of debts.”When your revenue is as much as your debt payment, it is a crisis mode.

The CITN president said the Institute had advised the government against running “a mono economy , saying, “you don’t depend on oil alone, you diversify the economy”,Adesina said.

Responding,Governor Ugwuanyi, who was represented by the Deputy Governor, Hon(Mrs) Cecilia Ezeilo, welcomed the team to Enuguand thanked them for choosing Enugu as the venue of the conference.

He said that Enugu state government is a major stakeholder in the Nigerian tax system ,” hence the state accord high regards to the courtesy visit .”

The Governor said that,” public revenue generation and tax administration , tax incentives reforms and issues around tax equity are fundamental policy issues and drivers that will always remain topical in public administration in both developed and low income economies.

He explained that ,”this is because, collecting taxes and fees is a fundamental way for countries around the globe(Nigeria inclusive) to generate public revenues that make it possible to finance investments in human capital, infrastructure and the provision of essential services for citizens ,residents and businesses.

“The International Centre for Tax and Development declares that taxes remain the most sustainable and reliable source of public revenue of any modern state. According to recent estimates, tax revenues account for more than eighty percent of total government revenue in about half if the countries in the world and more than 50 percent in almost every country.

“In Nigeria, the search for a sustainable source of public finance ,has brought taxation to the forefront of public discourse and attention .This is further reinforced by dwindling oil revenue, which has led to increasing reliance on public debt as a way of financing the country’s annual budgets and even supplementary budgets.

“But we know that both the International Monetary Fund(IMF) and the Organization for Economic Corporation and Development (OECD) have maintained that borrowing to support revenue is not sustainable. Our fiscal authorities have also collaborated this with calls for increased domestic resource mobile zation with a focus on taxation”, Ugwuanyi said.

Governor Ugwuanyi observed that given the low level of tax compliance in Nigeria, “there is a strong need for robust collaboration among all the stakeholders in the industry, especially, the government , the tax payers and the tax professionals, under the Chartered Institite of Taxation of Nigeria umbrella inorder to raise tax revenue and support the economy.

“Changing the tax profile of the Nigerian economy through the resolution of the age- long obstacles to improved tax revenue performance, thereby accelerating tax revenue mobilization would in the opinion of tax experts, involve a combination of accepting the reality of low tax compliance and systematically removing the obstacles to tax revenue mobilization.

Others include, “stimulating collaboration between government and tax payers for improved tax revenue, implementing policies on tax transparency, fostering partnership of government with tax payers on direct utilization of taxes on infrastructure, involving informal sector groups in tax compliance efforts , strengthening and expanding he whistle blowing policy to gather intelligence for tax enforcement”, he said.

Governor Ugwuanyi disclosed that Enugu state Internal Revenue Service(ESIRS), has been recording sustainable increase in the State’s IGR, due to some well thought out measures designed to make tax payment easier for tax payers in the state ,as well as the deepening of the relationship between the tax authority and tax payers.

“Our government has been implementing an ambitious four point development agenda since it’s inception aimed at impacting positively on the lives of the people.

“Achieving the aims of this very ambitious agenda, requires that government harnesses all the potential sources of internally generated revenues and the salutary thing in that ESIRS and it’s collaborating agencies , have been using tax collection systems that produce the desired results without putting additional pressure on the people.”, He said.

He expressed interest in the Theme of the conference, saying , that the state government looked forward to the conference coming forth with solutions and prescribing critical intervention roadmaps that address challenges around using taxation as an instrument for achieving rapid and sustainable development in the south east zone and it’s component states . He urged the institute” to use the conference to share a few secrets with the South East zone on how taxation can be made an enabler of rapid and sustainable development.”